23/03/2009 (Business Day) - Malaysia, which for a long time was the leader in oil palm business in the world ( Indonesia is now the world leader), got its first seedlings from Nigeria .

23/03/2009 (Business Day) - Malaysia, which for a long time was the leader in oil palm business in the world ( Indonesia is now the world leader), got its first seedlings from Nigeria .Malaysia knew long ago the potentials palm oil production had and therefore took the cultivation very seriously in an effort to boost its economy.

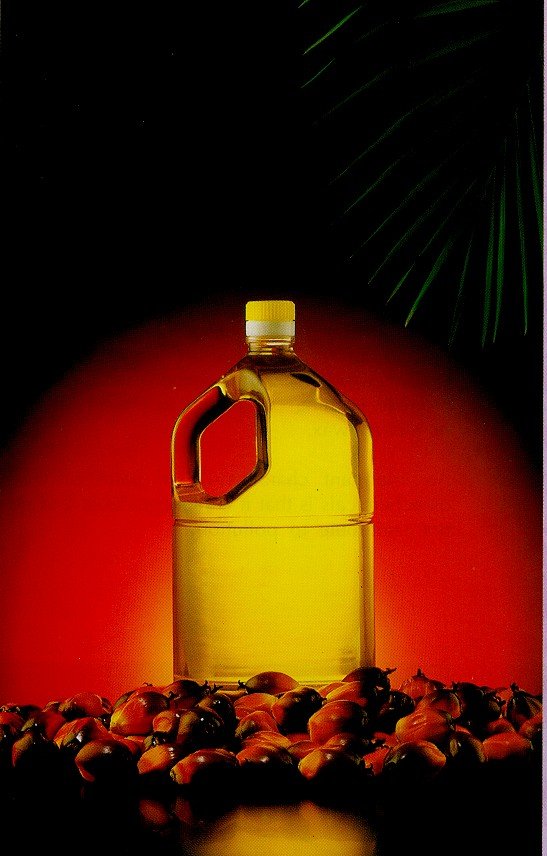

Malaysia has over 3.2 million hectares of oil palm plantations, milling out nine million tons of palm oil with earnings up to $7 billion from its export.

Malaysia has gone beyond fabrication of mills to the addition of value to the products by refining and fractionating oil in order to produce chemicals like the fatty acids, fatty alcohols and intermediates.

It would be recalled a Malaysian minister was quoted by Bernama news agency as saying Indonesia would likely overtake Malaysia as the world’s top palm oil producer in 2007, due to dramatically increased planting there, “From preliminary figures in 2007 it looks like Indonesia has already overtaken us in terms of production,” Plantation and Commodities Minister Peter Chin told reporters.

Chin said Malaysia was still the world’s top exporter but that Indonesia was “very close behind” and would probably claim top status in 2008. “We do not aspire to be number one all the time,” he said on the sidelines of a conference on sustainable palm oil production, in Sabah state on Malaysia ‘s Borneo Island .

Malaysia produced 15.82 million tonnes of crude palm oil in 2007, and earned 45.2 billion ringgit ($14.1 billion) in export revenue. Palm oil plantations account for 1.2 million hectares (2.97 million acres) of Malaysia ‘s 4.2 million hectares of land allocated for agriculture. Some 30 percent of the country’s palm oil is in Sabah . Malaysia and Indonesia together produce 85 percent of the world’s palm oil which is enjoying a boom on the back of strong global demand and tight supply.

Chin said with limited opportunities to expand agricultural land, palm oil producers will focus on increasing yield from existing crops by efficient growing techniques and replanting with better seedlings.

In an attempt to restore the oil palm to its prime position as well as agriculture as the mainstay of the economy the federal and state governments started revamping and establishing oil palm agencies. For example, states like Anambra, Abia, Cross River , and Rivers States established oil palm agencies while the federal government increased its funding to the Nigerian Institute of Oil Research (NIFOR) Benin . Anambra State Oil Palm Development Agency, established in 1989 by the Robert Akonobi Administration in the old Anambra State, was charged to execute the small holder oil palm development scheme of the state government as well as Oil Palm plantations, nurseries and Oil Mills amongst others.

Similarly, the oil palm development effort of other states has received priority attention. Specifically, the Anambra oil palm development agency was charged to execute the small holder oil palm development scheme of the state as well as to establish and expand oil palm produces among others. But this is now history. The agency has wound up and the assets/ liabilities inherited by the State Ministry of Agriculture shortly after the creation of Anambra state in 1992.

Only recently, the Federal Government lifted the ban on importation of crude palm oil. The Plantation Owners Forum of Nigeria (POFON) kicked against it. POFON found it illogical for the Federal Government to lift ban on importation of crude palm oil “when palm oil is now grown in 24 states of Nigeria” and wondered why Government was taking this step when that “there is no shortage of palm oil in the country”.

Federal Government has made provision for importation of crude palm oil at 35 per cent import duty. This has now replaced the former regime of total ban on the importation of vegetable oil into the country. POFON is not comfortable with this, and rightly so. It has petitioned the Presidency, the Federal Ministry of Agriculture and Water Resources and the Federal Ministry of Commerce and Industry.

POFON’s argument is that the investments made by indigenous and foreign investors in the oil palm industry, occasioned by the ban on the importation of vegetable oil, was monumental and unprecedented in the history of private sector investments in plantation agriculture in Nigeria . It argues the lifting of the ban on the importation of vegetable oil has not just exposed and threatened the investments of plantation owners given the long gestation of their investments, that it has also brought to the fore the critical issue of policy inconsistency, which has been the bane of our agricultural development.

The trend has been established and the reality is that the new import regime has put the fortunes of plantation owners in jeopardy as traders and end users now prefer to buy cheap imported crude palm oil. The result is that plantation owners are being forced to sell below their cost of production.

For POFON, “The reality is also that the big oil palm estates have started to cut back on their workforce. This is untoward for rural employment. Suffice it to say that plantation agriculture remains the largest creator and provider of rural jobs. For instance, it is bad omen for Presco Plc that has just upgraded their processing capacity, just as Okomu Oil Palm Company Plc has had to put on hold further construction work on their new 60 tons FFB per hour palm oil mill, which is intended to be the largest in Africa .

“All these investments have been made in the quest by plantation owners to improve the supply and availability of palm oil in the country. We are therefore surprised and disturbed that a policy has been put in place that is mindless of the gains that have been recorded and is set to take the oil palm industry back to the doldrums. We are afraid that if the present situation is not arrested, it will spell the death knell of the oil palm industry. The oil palm industry may not rise again and the dream and aspiration of the federal government to put the country back on the World palm oil trade shall remain a mirage.”

POFON believes that weakening the country’s agricultural production base and threatening rural employment will not be in tandem with the seven point agenda of Mr. President, neither will it serve the objectives of “Vision 20/20:20”.

If Malaysia could make it, if Malaysia that started off with palm oil seedlings it got from Nigeria could excel in the production of palm oil. And if Indonesia which was number two world producer could beat Malaysia to it to become number one, Nigeria should be able to establish the same feat. In fact we should know better now that we need not depend solely on petroleum as revenue earner; what with its pricing unpredictability.

It is the season of non-oil products, nothing else. We must key into it now.